vanguard high yield tax exempt fund state tax information

An offshore fund is generally a collective investment scheme domiciled in an offshore jurisdiction. On the next page youll find a list of Vanguard funds that earned a portion of their investment income from.

Vanguard Tax Exempt Etf Nysearca Vteb For Investors Wanting Quality Without Leverage Seeking Alpha

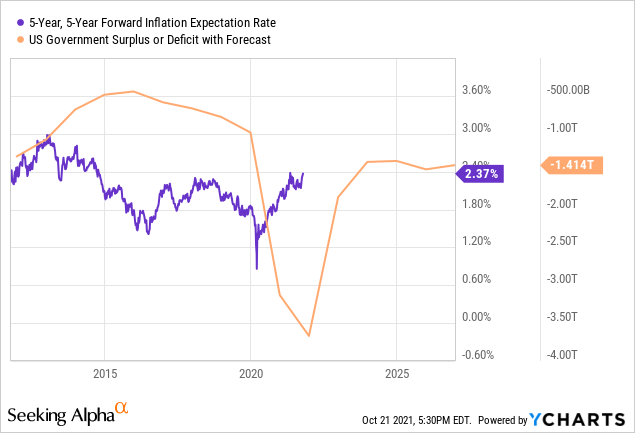

Money market fund yields have been headed lower across the industry since the Fed cut the fed funds rate in March to 000 to 0025.

. The yield before taxes that a taxable mutual fund or bond would have to pay to be equal to the tax-free yield of a mutual fund or municipal bond. 1908 million SEC yield. If the funds stable share price and market-based value per share deviate by more than one-half of 1 the funds board may determine to adjust the funds share price below 100 which is also colloquially referred to as breaking the buck Institutional prime and institutional tax-exempt money market funds however are required to use a.

The higher the tax bracket the more attractive the. Lots with the highest percentage gains in my taxable account to a donor-advised fund and there are other ways to eliminate capital gains such as. Personally Im in a high-tax state expect my taxable income to drop substantially in retirement and will likely be moving to a lower income-tax state.

One place to get tax-free municipal bond exposure is via an ETF wrapper with funds from Vanguard such as the Vanguard Tax-Exempt Bond ETF VTEB. A Treasury fund is a type of government money fund that invests in US Treasury Bills Bonds and Notes. It is suitable for investors in higher tax brackets but it.

High-yield muni portfolios invest at least 50 of assets in high-income municipal securities that are not rated or that are rated by a major agency such as Standard Poors or Moodys at the. Important tax information for 2021 This tax update provides information to help you properly report your state and local tax liability on income distributions you received from your mutual fund investments in 2021. I donate the lowest basis shares ie.

The fund invests primarily in obligations of state and local jurisdictions municipal securities generally exempt from US Federal Income Tax and to some extent state income taxes. Like the term offshore company the term is more descriptive than definitive and both the words offshore and fund may be construed differentlyThe reference to offshore in the classic case usually means a traditional offshore jurisdiction such as the Cayman Islands. The foreign tax credit is added to the dividend yield before computing taxes.

With a 006 expense ratio the fund offers low. And another one down. Or invest that money in a risk-free option like a high-yield savings account or CD.

One good choice is the Vanguard Total Stock Market Index Fund ETF Ticker symbol VTI. Tax-exempt interest dividends by state for Vanguard municipal bond funds and Vanguard Tax-Managed Balanced Fund Important tax information for 2021 This tax update provides information to help you report earnings by state from any of your Vanguard municipal bond funds and Vanguard Tax-Managed Balanced Fund on your year-end tax returns. This tax-exempt Vanguard money market fund invests in short-term high-quality municipal securities.

For example if a fund had 100 withheld in foreign taxes on dividends and you pay 20 in taxes on the. The interest may also be exempt from state and local taxes if you reside in the state where the bond is issued. A Second Vanguard Money Market Fund Hits the Near-Zero-Bound of 001.

Evaluate the Fees Most people investing 10000 dont. 035 The VanEck Vectors Short High-Yield Municipal ETF SHYD 2466 is an index fund that tries to deliver higher income without. The tax-equivalent yield depends on an investors tax bracket.

The final column of the second table in the top tax bracket assumes a tax rate of 046 for the tax-efficient fund and 150 for the tax-inefficient fund.

Vteb Vanguard Tax Exempt Bond Etf Provides 2 Yield With Less Interest Rate Risk Than Many Bond Funds Nysearca Vteb Seeking Alpha

Vwalx Vanguard High Yield Tax Exempt Fund Admiral Shares Vanguard Advisors

Vwiux Vanguard Intermediate Term Tax Exempt Fund Admiral Shares Vanguard Advisors

How Do I Determine The Exempt Interest Dividends F

Vanguard Tax Exempt Etf Nysearca Vteb For Investors Wanting Quality Without Leverage Seeking Alpha

Vwahx Vanguard High Yield Tax Exempt Fund Investor Shares Vanguard Mutuals Funds Investing Money Fund

Vanguard Tax Exempt Bond Funds Are They Worth It Bogleheads Org

Tax Information For Vanguard Funds Vanguard

Vwahx Vanguard High Yield Tax Exempt Fund Class Info Zacks Com

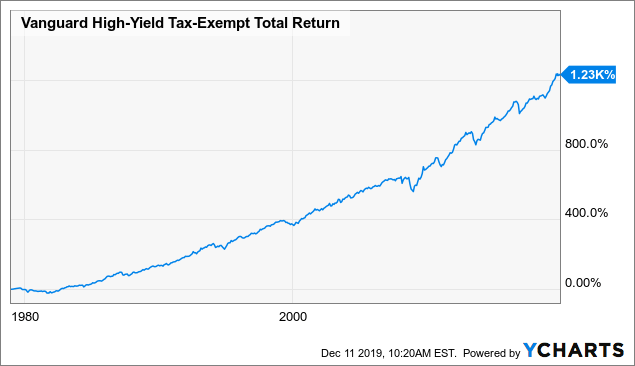

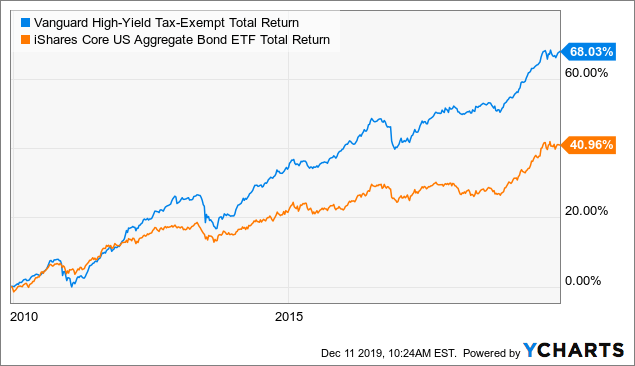

Vwahx 41 Years Of High Yield Municipal Income For Retirement Mutf Vwahx Seeking Alpha

Vanguard High Yield Tax Exempt Don T Call It Junk Kiplinger

Vwahx 41 Years Of High Yield Municipal Income For Retirement Mutf Vwahx Seeking Alpha

Vanguard Tax Exempt Etf Nysearca Vteb For Investors Wanting Quality Without Leverage Seeking Alpha

How Do I Determine The Exempt Interest Dividends F

Vwstx Institutional Ownership Vanguard Short Term Tax Exempt Fund Mutf Stock